What is an IPO? Initial Public Offering Explained

previous post

What is an IPO and what does it mean when a company goes public?

IPO stands for Initial Public Offering.

This means that it’s the first time a company’s stock is available for the public to buy.

Instead of “IPO” you may sometimes hear people referring to this event as a company going public. But what does it mean when a company goes public?

Well, we have to understand that in the context of what we’re talking about, businesses are classified either as private or public.

You probably started your snowcone company alone, you took your own money and you bought a stand to sell snowcones.

Business is doing great, and you start opening up more stands in your city, then a bunch of of brick and mortar locations. Snowcone has become the new Starbucks of your city.

But, you want to expand the business even further to locations across the country. To do that you need to raise money.

The first place you might start is asking friends or family. Maybe you know some outside person that wants to be involved in your company, or maybe you even go on Shark Tank.

You may have heard of terms like seed or angel investors, venture capitalists, and private equity firms.

This is where these groups of people come in. These are very simply just groups of people that invest money when companies are in their very early stages.

Usually, in exchange for money, you would give these people equity or part ownership in your company. We would consider these people private investors. And this is how many businesses start out.

At this point, your snowcone company is still considered private. Even though you may have a few random outside investors helping you out, or even your mom, these are independent people or firms that are coming to you directly – so we would refer to these people as private investors.

So at this point, it’s just you and your private investors. Your neighbor can’t go on Yahoo Finance and look up Snowcone’s stock price, they can’t buy it on Robinhood. And YOU can’t go in and list it on Yahoo Finance or Robinhood either.

But if your snowcone business grows fast enough, you may find that in order to keep growing the business, you need to raise more money than what these private investors can offer you.

This is where an IPO comes in.

By making part of your company available for outside institutions and the general public to buy and trade, you have the potential to raise a lot of money. And when you choose to do that, that is when we say a company is “going public”.

So, in order to get Snowcone to the point where it is listed with other stocks on the NYSE, your company has to go through an IPO, or initial public offering. This process usually starts with an investment bank.

There are a few things that the investment bank is going to determine. They’re going to make sure you’re legitimate, and that there isn’t anything sketchy going on with the company’s financials or management, they’ll determine the valuation of the company, or how much the company is worth.

Then you’re going to determine how much of the company you’re going to make available to the public to buy, in other words, how much of the company you’re giving up ownership of.

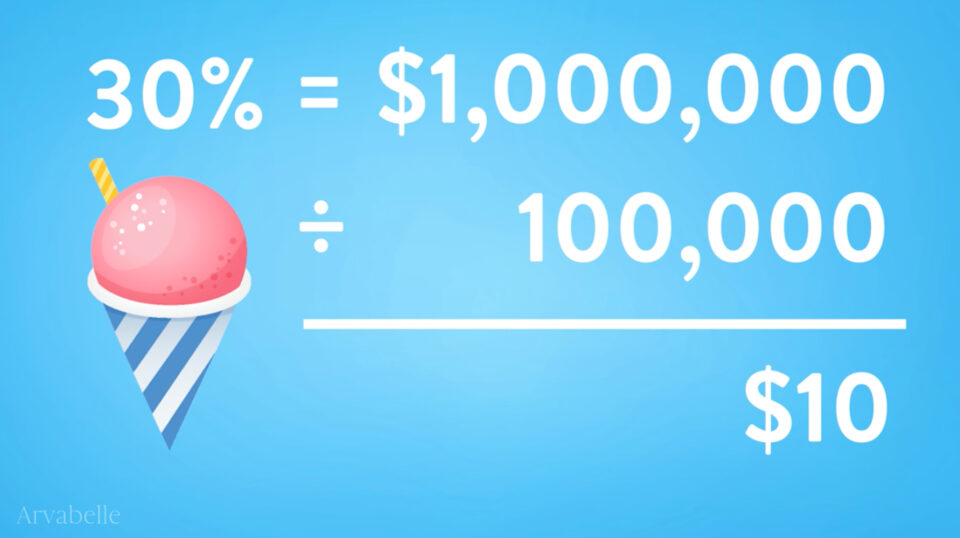

So maybe you come to the agreement that you’re going to give up 30% of the company, which let’s say is worth $1 million.

The next step is to determine how many shares make up that $1 million, and what price they’ll be sold at. So for example if you split that $1 million into 100,000 pieces, that would be 100,000 shares available at $10/share.

The investment bank will then essentially buy the 100,000 shares from you at that set price.

This whole process is called underwriting.

It’s also the investment bank’s job to distribute those shares that they bought from you, and to help your company file with the SEC and get listed on a stock exchange.

In addition to what we talked about, they’re also going to help you market your stock and generate interest in it, from investors, firms, brokerages, and the general public.

This is the point before an IPO happens where you typically hear a lot of hype about a company.

Now somewhere during this process, before the general public able to buy into your company, the investment bank is going to circulate this around to different institutions and investors.

These institutions and investors are able to submit an IOI or an Indication of Interest.

It’s not a binding contract or anything, it’s basically just these institutions and investors saying “yeah I’d buy that”.

A normal person usually can’t get access to an IPO that early on. We have to wait even longer, until it’s made available to retail investors, which are people like you and me who are buying through Fidelity, or Robinhood, or any of your normal brokerage accounts.

This is one reason why IPOs can be considered risky. By the time the stock is available for retail investors to purchase, there is a good possibility that it will be overpriced.

In The Intelligent Investor, Benjamin Graham famously said that IPO really stands for “It’s Probably Overpriced”.

That investment bank’s goal is to sell the shares to the public for more than they paid the company for it. So in this case your company is Snowcone, and they bought those 100,000 shares from you for $1 million.

So when they sell those shares to the public, they want those shares to be valued at more than $1 million dollars.

They obviously want to make money, and the company obviously wants to make money, so that’s just something to be aware of.

A lot of the stock’s initial movement can be based a lot on hype and speculation instead of the company’s actual fundamentals or performance.

Also keep in mind that a company chooses when to go public, so they’re clearly going to want to pick the best time when they think they can get the most money.

So with IPOs, what happens after the company does actually go public?

Well you may see owners and employees selling some of their own shares for cash, and you may see the same with private investors. People do this either to cash out a little bit, or to make an exit completely.

If you had gone on Shark Tank and Mark Cuban was a private investor in Snowcone. He’s been helping you out for a while, but is ready to get out of the company and take a profit. So, when you go public, it’s possible that he will sell his shares and leave the company.

(In actuality it’s a bit more complicated than that, but that’s the basic idea.)

So if you are employed at a startup, and they give you equity or shares in their private company as part of your compensation, if that company ever chooses to go public, that could be a fantastic payday for you.

Think about early employees at Amazon and Tesla. If company shares were included as part of their compensation, those shares would be worth a lot more now than they were when the employees received them.

This is also the reason that many high net worth individuals get into angel investing. Essentially they want to get in on those initial rounds of funding in hopes that the company will one day go public.

But what actually happens to the price of stocks when a company goes public? Well, it’s hard to say.

Many will see a sharp spike in price and an equally steep decline. Some will level out, some will continue to climb higher, and some will decline and never recover.

There isn’t a one-fits-all scenario for what happens after a company’s IPO.

What’s getting interesting about IPOs is that there are now ways that companies can actually get around that long traditional IPO process. They do this through something called a SPAC.

Click here to find out why SPACs and are becoming so popular, and how companies are avoiding the traditional IPO route.

Suzanne Ctvrtlik is the founder of the personal finance blog and YouTube channel, Arvabelle.

M1 Finance is a commission free app that allows you to easily automate your investing.

Get a $30 bonus when you fund your account with $1000+.

Robinhood is a commission free investing app with no account minimums.

Get 1 free stock when you sign up.

Public is a social investing app with no commissions and no account minimums.

Get a $10 stock slice when you sign up.