This week Elon Musk invested $1.5 billion of Tesla’s money into Bitcoin. This is why Cathie Wood thinks Bitcoin could hit 500k, and how Elon Musk and Tesla play into it.

People like Cathie Wood have been anticipating this for a while, and even Andrei Jihk predicted this earlier in the year on Logan Paul’s podcast.

We’re not unfamiliar with Elon Musk’s tweet storms that drive up prices of pretty much anything he mentions or puts in his Twitter bio. But moving $1.5 billion into Bitcoin is a really significant move for a company, and a really significant moment for crypto in general.

So today I wanted us to take a look at some of the interviews Cathie Wood has done. We’ll break down in simple terms what she is actually saying about bitcoin, why she believes the price could eventually hit $500k, and how Elon Musk and Tesla play into this potential domino effect that she talks about.

I’m neither encouraging or discouraging you from buying bitcoin or following people like Cathie Wood or Elon Musk. But if this is something that you’re interested in, it’s important to start to break down these interviews and reports, and then you can decide for yourself whether or not you agree with these people or investment choices. So hopefully this can help be a stepping stone for that.

Search Volume of Bitcoin

The first point Cathie Wood has spoken about, is the level public interest and search volume of Bitcoin now, compared to what it was in the big 2017 run up.

If you go to trends.google.com, you can look up the search volume for any word or phrase. On a scale of 1-100, it will show you how frequently that word or phrase was actually searched for.

These trend graphs are important because it starts to show you the interest of the masses and can indicate where you start to see pandemonium.

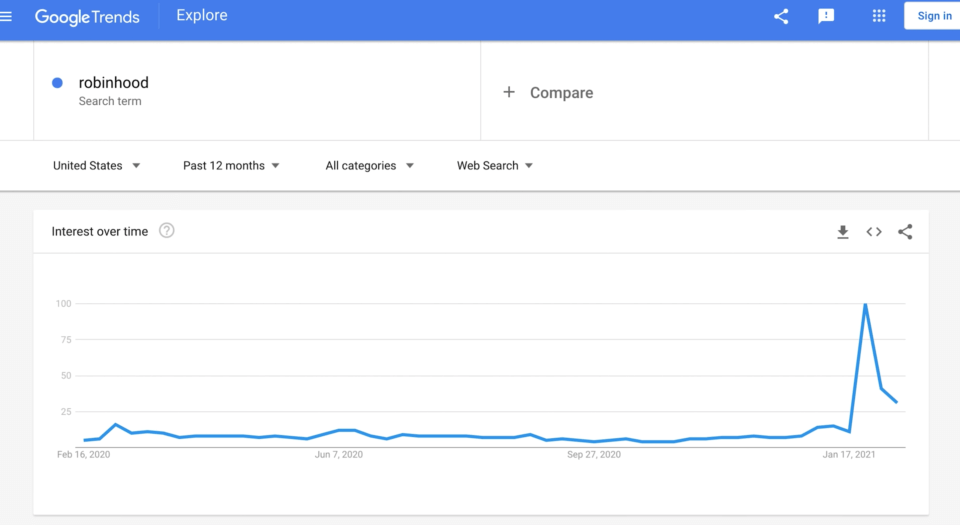

If you search for “Robinhood” for example, you’re going to see a massive spike at the end of January. That means a massive amount of people were searching for it.

If you search something mundane like lettuce, probably the only spikes you’re going to see are whenever there was an e-coli outbreak. Many times these trend graphs co-inside with mainstream media coverage or mass interest in general.

2017

2021

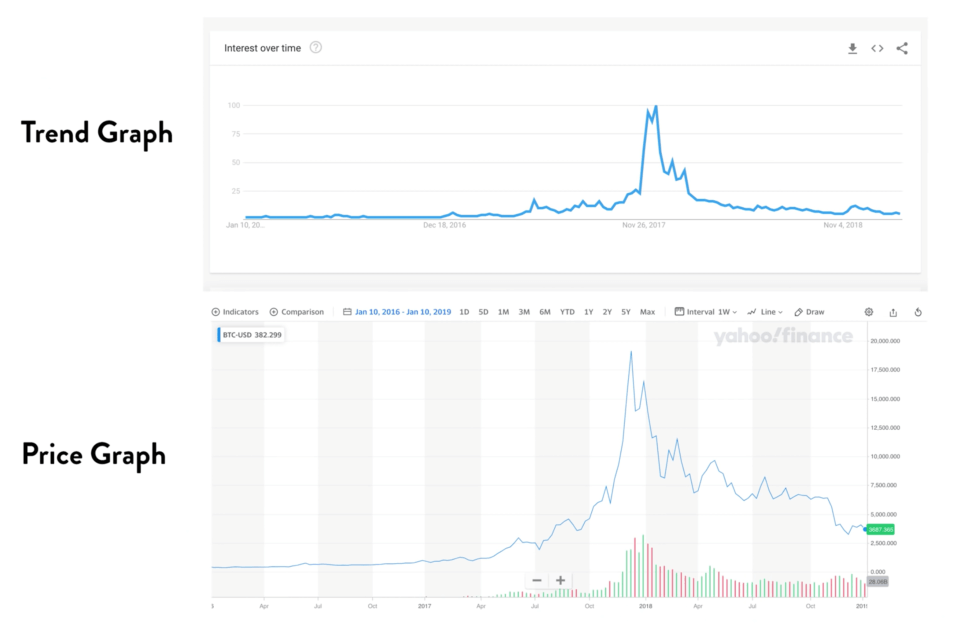

If you put Bitcoin into google trends, you get this graph of search interest over time, and it looks very very similar during that time to the actual price of bitcoin. Cathie Wood said that it was moving at almost a 1:1 ratio of the search volume and the price.

If you pull up the actual graph of bitcoin price during that time, she’s right. They’re almost exactly the same. Was the price driving the interest? Was the interest driving the price? Probably a little bit of both!

But what she’s saying is that we’re not seeing that now. If we overlay these graphs on top of each other, the price is at an all time high, but the search volume isn’t. The hype and the interest around it isn’t the same as it was in 2017.

This could potentially mean that it’s not solely the retail investors driving the price up – it could be institutions.

Why does Cathie Wood think Bitcoin could eventually hit $500,000?

If you watched any of Cathie’s interviews, or read any of the reports that Yassine Elmandjra has written on Bitcoin, a common subject they like to bring up is what could happen if large companies and institutions started putting 1% of their cash into Bitcoin. (And what would happen if they raise that up to 5%.)

Large companies like Tesla have already started to allocate some of their money towards Bitcoin.

She believes these large companies investing would be the driving factor that causes the price of Bitcoin to eventually reach $500,000.

There are other examples of companies investing in Bitcoin as well.

Microstrategy is a company that has put some of their money into Bitcoin already. We saw Tesla do the same, and there’s already speculation about whether we will see any of the other FAANG companies follow in Tesla’s lead.

In these interviews, Cathie also brings up companies that you have probably heard of, like Square and PayPal. They are also trying to dip their toes into the crypto space.

Even MassMutual, which is an old, conservative life insurance company has recently started getting into Bitcoin as well.

Cathie Wood has pointed out that because MassMutual is such an old company and considered very conservative, it’s a big step for them to have jumped through all of the legal paperwork and loopholes.

If they were able to successfully do that, other companies and institutions will possibly be able to do the same.

Why does Cathie Wood believe that companies like Tesla investing in Bitcoin would affect the price so much?

Cathie has mentioned that the market cap of Bitcoin seems comparatively small when looking at the value of existing companies.

Market cap is the total value of all the shares of a company.

So what she’s saying is that the total value of Bitcoin is less than a company like Apple or Amazon – but she believes that Bitcoin is a much bigger idea.

Again, she believes if every company in the S&P 500 just put 1% of their cash into Bitcoin, that alone would drive the price up.

Why would companies want to invest in Bitcoin?

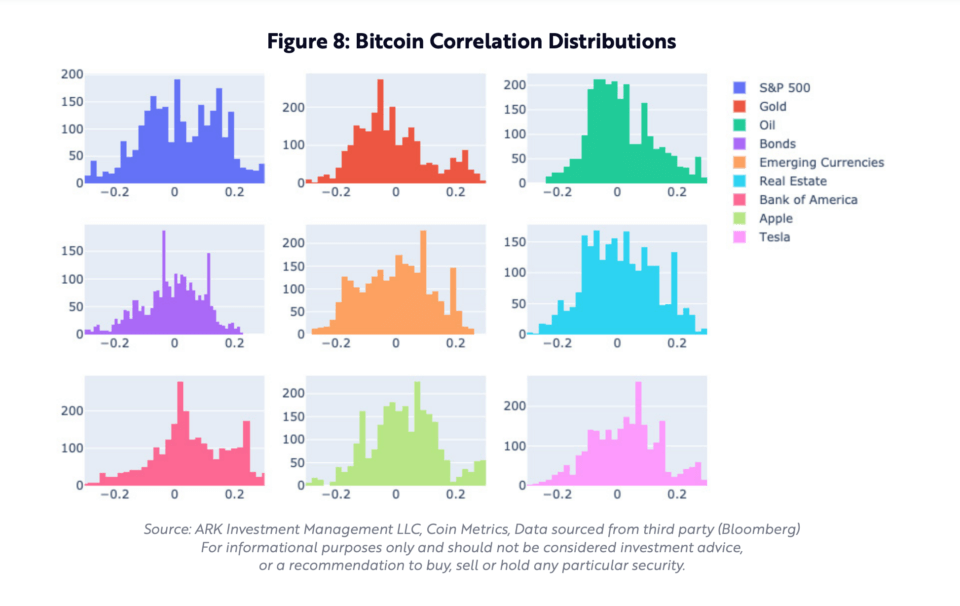

In this report written by Yassine, they say is there is the lowest correlation between Bitcoin and any other asset class.

What does that actually mean?

On pages 10 and 11 of this report, we can see how they compare the movement of Bitcoin to the movement of other asset classes.

All they mean by the correlation is how these move relative to each other. (Does the price of gold affect Bitcoin? etc)

In these graphs, you can see many of them hover around 0. For the most part, they stay in that -.2 to .2 range.

What this comes down to, is that because Bitcoin is not super closely related to any of those asset classes, it makes it a good option for companies and institutions to potentially diversify.

It can serve as a hedge against any other assets that they have or even the cash that they have.

If one asset class goes up or down in value (or even the US dollar), that doesn’t necessarily relate to Bitcoin. For that reason, they can use Bitcoin to hedge against some of their other assets.

How will Elon Musk investing in Bitcoin affect other things?

We might expect to see other companies join in. On top of that, it’s possible that we’ll see a bit more talk of Bitcoin and cryptocurrencies being integrated into kind of the traditional Financial space.

Fidelity has been pretty vocal about wanting to include Bitcoin transactions on their platform.

We already saw Robinhood include that on their app, and we have seen a few other companies start their own crypto-related funds.

Tesla investing in Bitcoin could of kick off that initial interest in how other companies and institutions can start to include Bitcoin into their own businesses.