Automate your finances to save more money, stick to your budget, and keep your credit score in check.

What does automating your finances mean?

To automate your finances, you’re building a process to help easily manage your money. Once set up, your money will essentially be on autopilot.

When you automate your finances, this typically includes auto-paying bills, and automatically moving money into your savings accounts and investing accounts.

Luckily automating your finances is easy. It will take a bit of time to set up, but once your system is in place, it can save you the time and headache of tracking down your money every month.

Why should you automate your finances?

When you automate your finances, you’re making sure that your bills are paid on time, you never miss a credit card payment, and you’re meeting your budgeting and saving goals.

All of these things can save you money. You won’t have to worry about late fees, hurting your credit score, or spending your emergency savings on frivolous things.

By automating your finances, you’re reducing the stress of managing your money, and setting yourself up for financial success.

How to successfully automate your finances

Not sure how to start automating your finances? It’s simple! Here are our top tips and resources to automate your finances.

1. Pay yourself first

A tip you’ve likely read from financial gurus or finance books is to pay yourself first. But what does that mean?

Paying yourself first means intentionally setting aside a portion of your income for savings and retirement, before spending on anything else.

Saving 10% of your earned income is a good goal to start with. Let’s look at how to automatically set aside this money every month.

In order to start automating your finances, you should set up direct deposit if your employer offers it. Direct deposit is the standard for most companies – this is the easiest and most consistent way for you to get paid. With direct deposit, your paycheck is automatically deposited into your checking account.

In addition to setting up direct deposit, you should also have any contributions going to company retirement plans automatically deducted from your paycheck.

(This company-sponsored retirement plan will likely be a 401(k) or 403(b) for many people.)

For these retirement plans, some companies match a percentage of your salary. It can be a good idea to automatically contribute the maximum amount that your employer will match.

For example, if your employer will match up to 2% of your salary, it would be beneficial to contribute the full 2%.

Once you have direct deposit and your 401(k) contributions set up, it’s time to automate the rest of your finances. The day your paycheck balance is available in your checking account, automatically transfer 10% into your emergency fund, investing accounts, and savings accounts.

We’ll discuss the easiest way to do this with M1 Finance in Step 5.

2. Set up automatic bill payments

The next step to automate your finances is to automatically pay your bills on time, and in full. (Yes, this includes your credit cards!)

The payments for your utilities, mortgage, loans, subscriptions, and credit cards can be automated so that you never have to worry about missing a bill. We hate late fees!

Always know when your bills are due

It’s extremely important to know the date your paycheck is settled in your checking account, and the dates your bills are due. This will help you create a payment schedule. You always want to have enough funds in your checking account to cover your upcoming bills.

Download our free bill payment tracker

Worried about weird payment dates?

No problem! If you’re worried about automating your finances because of weird bill due dates – don’t be! Usually if you call your service providers or credit card companies, they’re happy to adjust the due date for recurring charges.

You can adjust the dates to work around your paydays. Taking this small step will ensure that you know when your bills are due, and you’ll never have an unexpected overdraft fee!

Now that you know when your bills are due, you can easily set up automatic payments.

Automating the payments

To set up automatic bill pay, you’ll need to go to the website or apps of each of your service providers. Under your billing options or account settings, you’ll be able to enter your credit card or bank information. On this page, you’ll usually have the option to opt-in for automatic or recurring payments.

Using a credit card?

Using a credit card makes it a breeze to automate your finances. Once your bills are connected to your credit card, you’ll just need to connect your credit card to your checking account.

Log into your credit card account, go to your billing or payment settings, enter your bank information, and select when and how much of the credit card bill you’l like to pay off.

You’ll usually have the option to choose the full statement amount, or the minimum required payment amount.

To avoid hurting your credit score, it’s best to pay off your credit card balance on time and in full every single month.

Using a bank account?

Some charges, like rent or your water bill, can’t be paid with a credit card. What should you do for these?

Most banks offer an option online bill pay. You only have to set it up once, and your bills will be automatically paid through your bank. Log in to your online banking account, find the bill pay page, enter the billing information for the recurring charges, and choose when/how often you’d like to pay.

Even though your bills are now set up to be paid automatically, always review your bank and credit card statements. If there are any incorrect or suspicious charges, you’ll want to catch those as soon as you can!

3. Automatically track your expenses

Now that automatic bill payments are set up, you’re one step closer to automating your finances!

The next thing we need to do is to get your spending in check. With automatic payments set up, it can be easy to forget where your money is going.

We would recommend always tracking your expenses and keeping a budget. The best part? You can automate that too!

With a free app like Mint, you can connect your bank, credit card, and investing accounts to keep track of your money in one place. Every time you spend money, the charge is categorized. At any point you can go back and review where you spent your money.

This information is important to have so that you’re able to create a realistic budget for yourself. You can create a budget directly inside the app! Whenever you spend money, the amount left in your budget will adjust accordingly.

You won’t know where to cut back if you don’t know where you’re spending – so start tracking!

4. Automate your investment accounts

The most important step to automate your finances is to set up automatic investing.

M1 Finance is an investing brokerage that offers several features to make automating your investments easier.

You can open several different investing account types on M1 Finance (individual, joint, Traditional IRA, Roth IRA, SEP IRA, and Trust accounts).

Advanced customization

Your M1 Portfolio is visualized as a “pie”. These investment pies are fully customizable, ready for you to add the stock and ETF slices that you choose. In addition to choosing what you’d like to invest in, you can also choose what percentage of your portfolio you’d like to allocate towards each slice.

Because of this “pie” structure, M1 Finance is one of the easiest platforms to use to automate your finances. When you add money to your account and turn on automatic investing, M1 Finance will distribute the money across your portfolio (keeping the percentages as close as possible to your desired amounts).

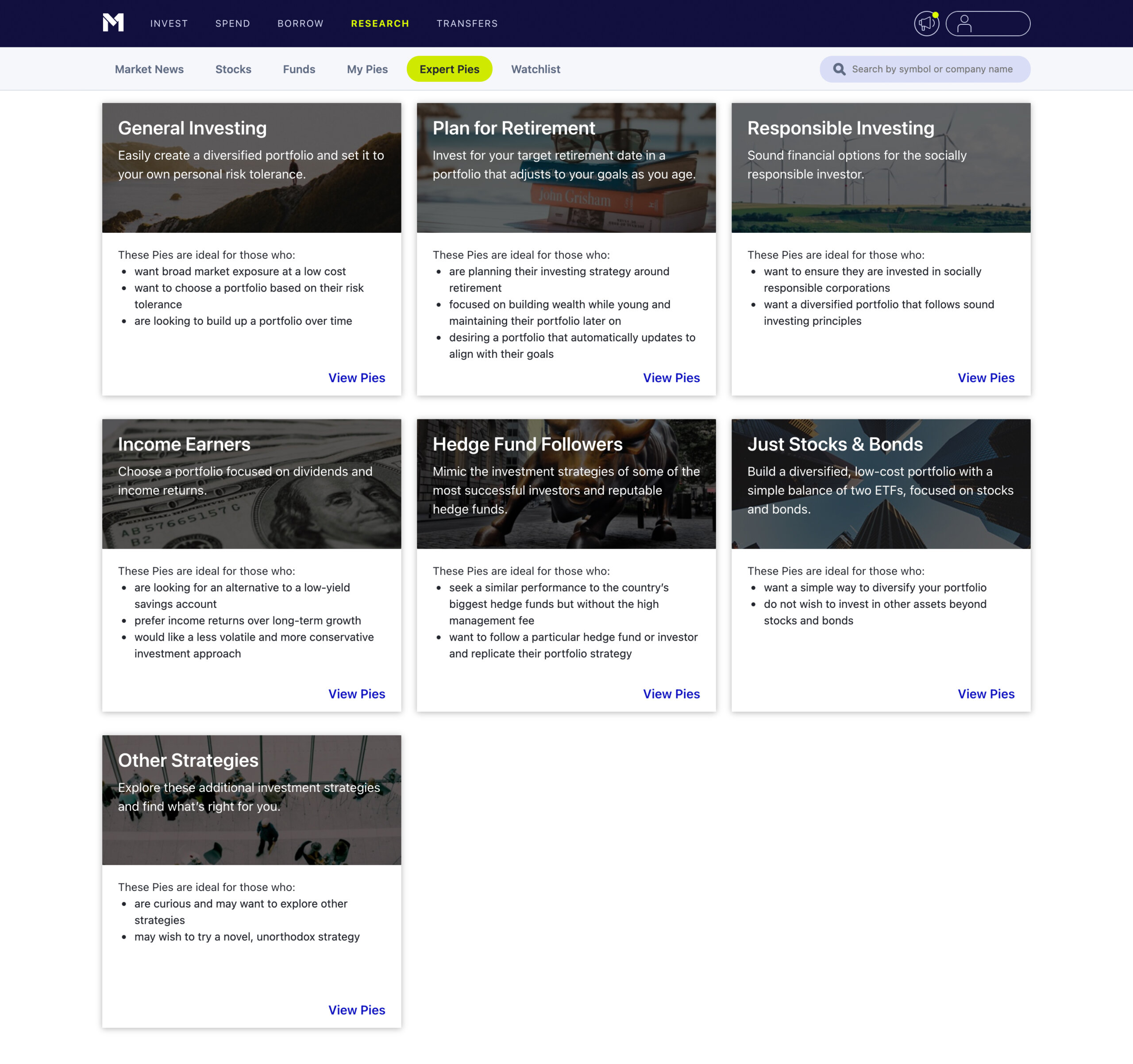

M1 Expert Pies

Don’t want to choose your own stocks? M1 Finance offers a selection of pre-made investment portfolios to help you reach your goals.

From retirement portfolios, to dividend portfolios, to socially responsible investing, there’s an expert pie for everyone.

Automatic investing schedules and dividend reinvestment

Link your bank account and easily set up a recurring transfer schedule. Choose the day(s) you’d like the money to be transferred into your account, and never worry about manually transferring again!

If you’d like to automatically invest all of your cash and earned dividends, turn on auto-invest and you’ll be good to go! You can set a minimum cash balance for your account, and investing will be initiated once your cash reaches $25 over that amount.

Example: If you set your minimum cash balance to $100, trading will be initiated whenever your cash balance is at least $125.

$25 will be invested, and $100 will stay in your cash balance.

When you use auto-invest in combination with automatic transfers, you’re one step closer to automate your finances completely!

5. Automate your emergency fund & savings goals

Now that you have your income, bills, budget, and investments on auto-pilot, it’s time to address your savings. The money that goes towards your emergency fund can be part of that 10% you set aside, or it could be additional money that you set aside at the end of the month.

Savings accounts may be a good choice for short term savings goals. However, for longer term goals, consider the idea of investing while you save!

On M1 Finance, if you’d like to invest the money you’re saving, you can create a new pie for each goal. For example, you could have a “Rainy Day” pie and an additional retirement pie.

To make your life easier, you can consolidate your accounts with M1 Finance. M1 Spend and Smart Transfers can help you fully automate your finances and reach those savings goals.

M1 Spend is an FDIC-insured checking account and debit card. With M1 spend, you can set up direct deposit and recurring transfers to fully automate your finances.

Start putting your money to work by directing extra cash to your different investment pies with Smart Transfers. You can tell M1 exactly where you want your extra money to go. This is the easiest way to put your accounts on auto-pilot.

Watch the video below to see how Smart Transfer work.

There are lots of different ways to reach your personal financial goals, but automating your finances certainly makes money management less time consuming, and more enjoyable.