Socially responsible investing (SRI) can be a great way to build a more sustainable and ethical portfolio. Read on to find out what socially responsible investing is, and how you can get started.

For people who want to invest in companies and industries whose values and practices they support, socially responsible investing may be an option to consider.

What is socially responsible investing?

Socially responsible investing, or SRI, is an investment strategy that focuses on the social, environmental, and ethical practices of companies. The goal of socially responsible investing is to support companies making a positive impact. It also excludes companies making a negative impact.

Types of socially responsible investing

There are several different types of socially responsible investing. The type you choose will likely depend on your individual values and beliefs.

SRI

SRI, or socially responsible investing, is a general term that encompasses different methods of sustainable and socially conscious investing. Socially responsible investments are typically judged on three factors – environmental, social, and governance. This is why the term “SRI” is often used interchangeably with our next term, “ESG”.

ESG

ESG is an acronym for Environmental, Social, and Governance. These are a few of the factors considered in each category.

Environmental

- Pollution

- Climate change

- Biodiversity

- Water security

- Ecological Footprint

- Resource use

Social

- Gender and racial diversity

- Human rights

- Labor practices

- Health & safety

- Customer responsibility

- Community impact

Governance

- Anti-corruption

- Corporate governance

- Risk management

- Shareholder rights

- Tax transparency

Impact Investing

Impact investing refers to an investing strategy that focuses on social impact. With impact investing, the returns may be lower than with other SRI investments. The main goal is to bring about positive social change. The profitability of these investments comes secondary.

Other Types of Socially Responsible Investing

There can also be other types of socially responsible investing. Your investing strategy may be aligned with specific religious beliefs, or based on values that you implement and practice in your own life.

Pros and Cons

Socially responsible investing comes with its benefits and drawbacks. While there are many good things about SRI, there are both pros and cons to be aware of when using this investing method.

Pros

- Investing while upholding your personal values. If you are hesitant to invest because you want to avoid certain industries or practices, socially responsible investing allows you an opportunity to invest without compromising your beliefs.

- Putting your dollars where you want to see change. Socially responsible investing provides an opportunity to support the companies working toward the changes you want to see.

- Encouraging companies to use ethical and sustainable practices. As SRI becomes a more widely used strategy, companies may see the benefit of integrating more ethical and sustainable practices into their businesses.

Cons

- No “one-fits-all” option. Not every stock or fund is scored equally. They may meet some of your criteria for socially responsible investing, but miss the mark on others. Just as individual values differ, the practices of these companies will differ. This leaves it up to you to decide what you ultimately want to invest in.

- Potentially lower returns. With some companies, the primary objective is their social impact. This could potentially mean lower overall returns.

- Greenwashing. Unfortunately, some companies make attempts to appear more socially responsible than they are. This is something to watch out for. Some companies may still engage in unethical practices, all while painting a public image of being environmentally or socially progressive.

Who might consider socially responsible investing?

- If your personal values are something that you don’t want to compromise on.

- You want to see social or environmental improvements in a specific area.

- If you have faith-related values that you abide by.

Socially responsible investing can be a great way to uphold your personal and religious beliefs (while still participating in the stock market!)

How to get started with socially responsible investing

Getting started with socially responsible investing isn’t as difficult as it seems. With a few easy steps, you’ll be on your way to sustainable investing!

1. Determine which ESG values are important to you

First, you’ll need to decide what categories are important to you. The factors you base your investments on are going to be personal and vary from person to person. These are just a few factors you could consider:

- Environmental impact

- Social impact

- Management & transparency

- How their supply chain operates

- History of controversy

- Involvement with specific products or practices

2. Choose a platform

Next, you need to select a platform. There are tons of platforms you can choose from to start socially responsible investing. You could use a traditional brokerage, or a robo-advisor. We recommend M1 Finance to start your SRI journey.

3. Find your investments

The next step is to find what you’d like to invest in. There are several ways that you can go about socially responsible investing.

Individual Stocks

If you’d like to pick your own individual stocks, that is always an option. For research, Yahoo Finance is a great resource. Simply search for the company’s stock you’d like to buy, and you should see a “Sustainability” tab.

Under this tab, you will be able to see the company’s environment, social and governance (ESG) risk ratings. Each company is given a score for the individual categories, as well as an overall score.

They are also scored for their controversy level.

From this page, you will also be able to see the scores of similar companies, as well as any involvement in specific activities (for example, animal testing or selling tobacco products).

Any individual stocks you choose can be added into your M1 Finance Pie, giving you the ability to fully customize your SRI portfolio however you’d like.

ETFs & Funds

ETFs and funds will be similar to finding your own stocks. You’ll want to look at the ETF’s holdings, in other words the stocks that are in that fund.

From there, you can research those stocks the same way, and determine whether they align with your values and goals.

Just like stocks, ETFs can be added your M1 Finance Pie. (You can even have a combination of both stocks and ETFs!)

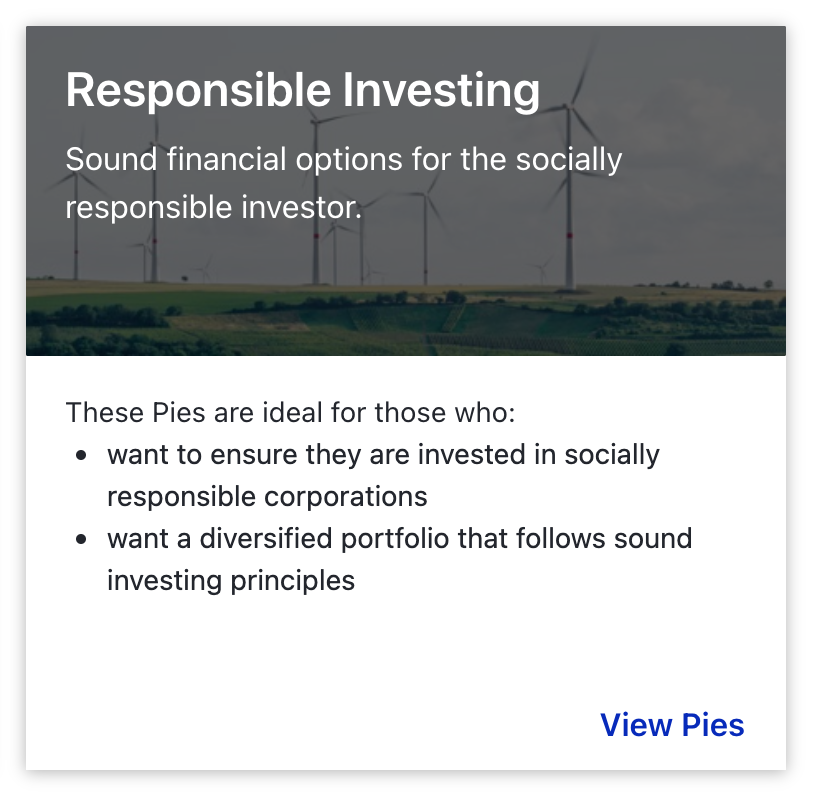

Pre-Built Portfolios

If you would rather have SRI-friendly funds preselected for you, robo-advisors like M1 Finance offer pre-build portfolios.

These, along with many other pre-built portfolios, can be found under the “expert pies” tab. You can take a look through these portfolios, and decide if any of them align with your investing goals.

The bottom line