Want to apply for your first credit card and start building your credit score? Find out the 5 categories that affect your credit score, as well as how you can establish credit for the first time.

** This post may contain ads and affiliate links.

A credit score is a number between and that basically lets credit card companies, banks, and lenders know how likely you are to pay them back.

They’re looking at your credit score to determine how much of a risk they’re taking by letting you borrow their money.

What score is considered good?

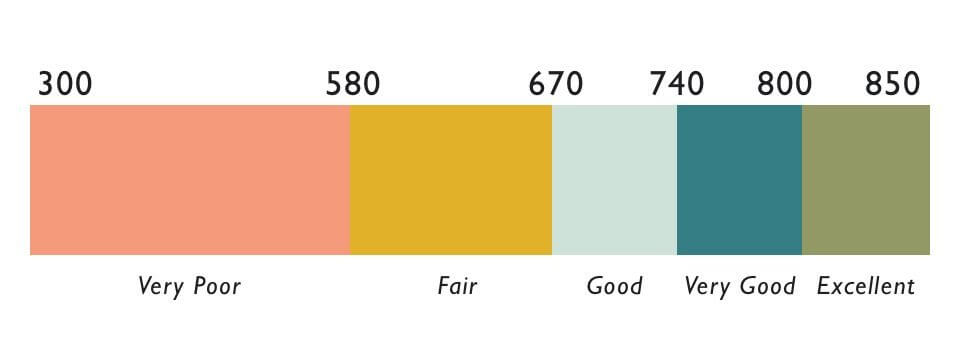

Exact ranges for what a “good” credit score is will depend on what type of loan or line of credit you’re applying for. It may also vary based on the company you’re checking your credit score through.

Though it may vary slightly depending on the situation, these are the typical credit score ranges:

300 – 580: Very Poor

580 – 670: Fair

670 – 740:Good

740 – 800: Very Good

800 – 850: Excellent

Why do I need a good credit score?

Your credit score is important because it applies to more than just credit cards.

In the future if you take out a loan for a car, a house, or college, these loans have a set interest rate that you will have to pay. Qualifying for a low interest rate on a loan will save you thousands (if not tens of thousands) of dollars over the course of the loan.

A good credit score will make you a more eligible candidate for loans and new/larger lines of credit.

The higher your credit score, the lower your interest rate will be.

The lower your credit score, the higher your interest rate will be. (It is also more likely that you will be denied for a loan or line of credit).

What affects my credit score?

1. History Length

Your history length is how long you’ve had a credit card open, or how long you’ve had access to lines of credit.

Don’t close old credit cards! It will close all the credit score history associated with that account.

Some cards will be shut down if they haven’t been used in a certain amount of time. Make sure your credit card company doesn’t cancel your card if you’re not using it! Call and ask what is required to keep the card open. Make a small purchase and check in every year or every few months to make sure your cards are still kept active. If your card has maintenance fees, ask if you can downgrade to a card without fees.

2. Credit Mix

Your credit mix is made up of the different types of credit you have available to you. Lenders like to see that you have a variety of credit and loans available to you. (For example: credit cards, student loans, car loans, mortgages)

3. Total Inquiries/New Credit

The total inquiries, or new credit portion of your credit score is how often you apply to new lines of credit.

Every time you go to apply for a new credit card or loan, your credit history is pulled for the application and “marked”.

As a general rule, don’t apply for more than 1 line of credit more than every 6 months.Applying for several lines of credit in a short amount of time will hurt your credit score.

It does NOT hurt to check your own credit score. You can use websites like CreditKarma to check your score for free.

The Largest Percentage of Your Credit Score Comes From:

4. Payment History/On Time Payments

Your payment history, or on-time payments category is exactly what it sounds like. Avoid late payments, or else your credit score will take a hit.

Always pay your credit card bill on time and in full!

If you’re worried about remembering to pay your bill on time, enable automated pay. This way, your credit card balance will always be withdrawn from your bank account on time.

You do NOT have to carry over a balance or pay interest to increase your credit score. Pay it off in full.

5. Amounts Owed/Utilization Rate

Your utilization rate, sometimes referred to as amounts owed, is the percentage of credit available to you that you’re actually using.

Credit card companies like to see a low utilization rate – usually less than 30% of the credit you have available. (For example: If your credit limit is $1000, you wouldn’t want to use more than $300).

The less money you use, the higher your score will be.

Having multiple credit cards is not inherently bad. If you’re racking up debt on all of the cards? Then yes, that’s bad. But if you’re using your cards responsibly, splitting costs between multiple cards will bring down your overall utilization rate.

How Do I Establish Credit?

1. Open a Bank Account

Open a checking and/or savings account at a bank that also offers credit cards.

Establish a good history with the bank. Actively use your account, and don’t overdraw it. Once you’ve proven that you’re a responsible banking customer, you can:

2. Start With a Secured Credit Card

If order to get a secured credit card, you will usually have to put down a security deposit of a few hundred dollars in exchange for a credit card.

Your security deposit acts as a safety net for the bank or credit card company. If you don’t pay it back your balance due, they will have that security deposit to draw from.

Pay back your balances due on time and in full.

3. After 4-6 Months: Apply for an Unsecured Card

An unsecured card is what most people consider a standard credit card.

You will have a set limit on your card, which you can build up over time by paying your bill on time and in full. (Notice the trend?)

The best way to start building your credit is to charge small, consistent, recurring amounts that you know you can pay off every month. (For example: Netflix or your phone bill).

4. After 12 Months: Apply for Charge Card

A charge card is a card with no limit, that you pay off in full every month.

Since there is no credit limit on the card, charge cards won’t impact the utilization portion of your credit score.

5. Become an Authorized User

Another option to build credit (or repair bad credit), is to become an authorized user on someone else’s credit card account.

If you have a parent, spouse, or older sibling with good credit, becoming an authorized user on their account will positively impact your credit score. (Essentially, you’re just piggy-backing off of their good credit to increase your own).

This is a great way to establish credit when you’re young. Most credit card companies will let you become an authorized user at the age of 16.

Asking someone to become an authorized user on their account comes with responsibility. It’s not a small thing to ask, so don’t expect anyone to add you to their account. (Especially if you haven’t proven that you’re responsible with your money).

How Should I Use My Credit Card?

If you’re just getting your first credit card, it’s important to be responsible and use it just as you would use cash or a debit card. Credit cards are not free money. It’s money that you still have to pay back, so avoid money traps. Don’t spend money that you don’t have.

The goal of building credit is to be able to leverage your money later on. There can also be other benefits to credit cards, such as rewards programs and sign up bonuses. But for beginners, it’s best to get into the practice of only buying what you can afford and paying off lines of credit ON TIME and IN FULL.

Spend responsibly. 🙂

DISCLAIMER: Please note that I am not a financial advisor. These videos and articles are for educational/entertainment purposes only.

As always, directly contact your credit card companies, banks, and lenders for questions about their specific services and requirements.